As the world digested the severe health and economic impact of COVID-19 in March of 2020, markets experienced a dramatic drawdown that has not been witnessed since the Great Financial Crisis. In particular, a brief run on liquidity created large technical dislocations in fixed income and credit segments, and market participants questioned whether companies could survive a prolonged economic shutdown. The Fed swiftly stepped in with aggressive monetary easing and a flurry of lending facilities, which quickly normalized treasury, mortgage, and corporate debt segments. The drastic market moves signaled an end to a 12-year bull run and many money managers began the process of raising dislocation strategies that focused on taking advantage of the new paradigm.

This article will attempt to define dislocation strategies, the opportunity set, and the market evolution over the last three months.

The main appeal of a dislocation strategy is to utilize fresh capital to take advantage of a short-to-medium term investment opportunity that is impaired for technical or fundamental reasons. Before examining the dislocation opportunity set in greater detail, investors should consider the following:

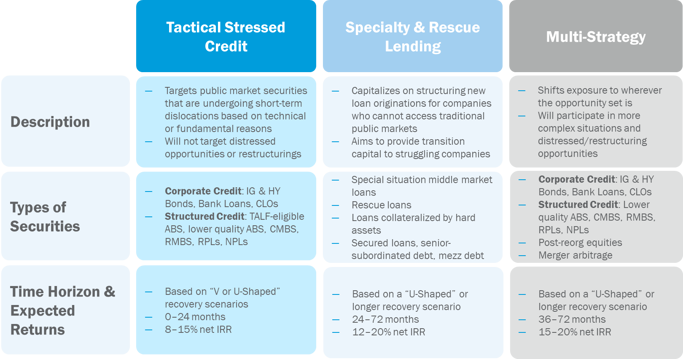

Newly formed dislocation strategies do not have to worry about balancing pre-existing positions and have the ability to concentrate positions in high conviction investments. Most funds are formed as closed-end GP/LP structures that have set investment and maturity periods. While strategies and opportunities can range between different categorizations and segments, Canterbury defines the current dislocation landscape in three broad categories: Tactical Stressed Credit, Specialty & Rescue Lending, and Multi-Strategy. The chart below describes the opportunity, the types of securities used, the time horizon, and the targeted returns:

Tactical stressed credit funds target public securities that undergo short-term price dislocations based on technical factors caused by large market disruptions. Strategies focus on individual fixed income segments or rotate across multiple corporate and structured credit sectors. Timing is key, since high quality securities can quickly recover if volatility is short-lived. Managers need to be prepared well in advance and have the fundamental analysis on underlying companies completed prior to a drawdown.

In recognition of an aging credit cycle, several money managers raised contingent capital funds in 2019 that were structured to deploy when certain market thresholds or triggers were met. As a result, these funds called and invested capital in March as volatility spiked and credit spreads widened. The environment was ripe to allocate to select investment grade corporates, high yield corporates, and securitized products. However, the opportunity was fleeting as the Fed stepped in with aggressive monetary accommodation. Shortly after the Fed’s announcement, corporate bond spreads tightened in April and May.

U.S. Corporate Spreads

Exhibit A. Source: FRED Economic Research: ICE BofA US Corporate Index Option-Adjusted Spread, ICE BofA US High Yield Index Option-Adjusted Spread as of June 30, 2020.

Certain asset-backed securities (ABS), mortgage-backed securities (MBS), and municipal bond securities also experienced meaningful retracement given the Fed’s bevy of lending facilities. In particular, the Fed’s reintroduction of the Term Asset-Backed Securities Loan Facility (TALF) resulted in an influx of investor and manager interest. The program allows investors to borrow at attractive rates on a non-recourse basis in order to invest in and enhance returns on high quality U.S. ABS, commercial mortgage-backed securities (CMBS), and other securitized loan assets.

In March, the availability of cheap financing, relative safety of the securities, and dislocated pricing resulted in money managers separately raising anywhere from $500 million to $1 billion in an expedited manner. TALF officially launched in June. However, TALF-eligible securities experienced meaningful price rebounds in April and May as investors turned more constructive. While another significant drawdown could make TALF risk-adjusted returns attractive again, the short-lived opportunity is an example of how fleeting shorter-term liquid dislocations can be.

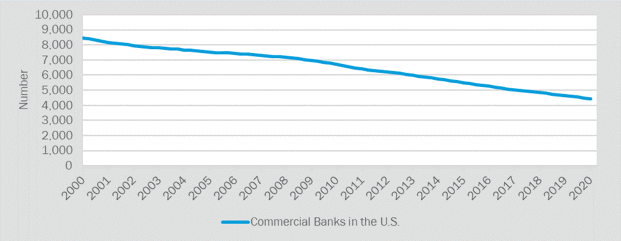

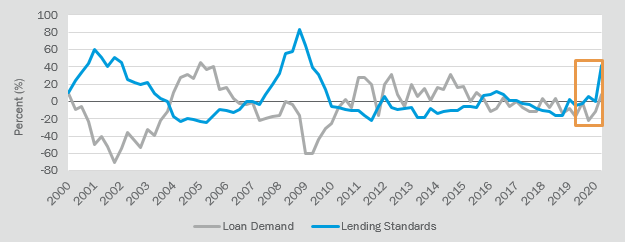

Specialty and rescue lending funds originate loans and create unique financing structures for companies that do not have access to traditional public markets. The primary objective is to provide access to transition capital for companies that are a going concern. Moreover, these strategies are not trying to take control or steer companies through restructurings. Companies that require flexible and unique financing are typically found in the middle market, which is classified as a subset of companies with no more than $50 million in Earnings before income, tax, depreciation, and amortization (EBITDA), as defined by S&P Global. Many of these companies do not have the appropriate capital structure or borrowing need to be attractive to traditional U.S. banks, given the steady consolidation and increased regulation in the space. Exhibit B shows the decline of U.S. banks while Exhibit C displays how loan demand and lending standards have fluctuated over the last 20 years.

Commercial Banks in the U.S.

Exhibit B. Source: FRED Economic Research: Commercial Banks in the U.S. as of June 30, 2020.

Domestic Loan Demand & Lending Standards

Exhibit C. Source: FRED Economic Research: Net % of Domestic Banks Reporting Stronger Demand for Commercial & Industrial Loans from Large and Middle Market Firms, Net % of Domestic Banks Tightening Standards for Commercial & Industrial Loans to Large & Middle Market Firms as of June 30, 2020.

Historically, loan demand and lending standards tend to be uncorrelated to each other, however, both metrics meaningfully increased in April 2020. Banks were formally the largest sources of capital, but they have primarily focused on larger deal sizes post the Great Financial Crisis (GFC). If banks are reporting higher loan demand but also tighter lending standards, who is the incremental provider of liquidity?

Over the last several years, Collateralized Loan Obligations (CLOs) and loan funds have taken over as the predominant buyer base, but current stresses and dislocations could result in a slowdown in new loan issuance and forced selling in the secondary market. Furthermore, holders of loans will have a lower ability and willingness to invest in new debt issues since many will be focused on preserving the current portfolio or structure. Specialty lending strategies can potentially take advantage of the dislocation by providing financing at more attractive terms to companies that have shown a level of resilience during trying times. Assessing a manager’s ability to properly underwrite deals and eventually structure complex debt structures is of the highest importance.

Multi-strategy funds shift exposure to wherever the opportunity set is. These strategies are not dependent on a particular segment of the market going through a dislocation and the funds’ flexibility to pivot to wherever the opportunities are is an advantage. Multi-strategy funds can invest in many of the opportunities presented earlier in this article and transition into opportunities such as emerging market credit, short-term tactical basis trades, and/or corporate restructurings. Money managers need to have vast resources and a deep bench of experts versed in a wide variety of markets to successfully execute a multi-faceted strategy. The opportunities presented are similar to those expressed in an event-driven evergreen hedge fund. However, position sizes tend to be more concentrated and less liquid given the drawdown style vehicle structure. Furthermore, managers can deploy a fresh set of capital into new opportunities while evergreen hedge funds must continue to manage existing positions. Multi-strategy investment periods are also longer when compared to tactical stressed credit and specialty lending funds, given their flexibility to invest in distressed companies that have longer-term catalysts.

While Canterbury views the current dislocation opportunity set as three main categories, the market environment will undoubtedly evolve as the current crisis unfolds. Certain opportunities have already come and gone while others have yet to materialize. All three categories have advantages and disadvantages, but properly assessing investor return expectations, risk tolerance, and investment time horizon is paramount before allocating to any dislocation strategy.