A notable shift occurred in 2022 as money market fund (MMF) yields went from near zero to over 5% following the Federal Reserve’s (Fed) plans to tighten monetary policy in response to inflationary pressures. This surge in yields has attracted significant inflows, propelling MMF assets to record levels exceeding $6 trillion as of March 20, 2024. Looking forward, while interest rates may have peaked, the potential for rate cuts in 2024, as suggested by Fed Chair Jerome Powell, underscores the evolving rate environment and presents investors with an opportunity to explore alternative investment avenues amidst changing market dynamics.

Changing Rate Landscape

Money market funds, which tend to invest in high-quality, short-term debt instruments and cash equivalents had, for many years, provided minimal income to investors, reflecting the low interest rate environment that persisted in the years leading up to and during the pandemic. The Fed cut rates multiple times in 2019 in response to concerns about global economic growth and trade tensions. Furthermore, the outbreak of COVID-19 in early 2020 led to increased market volatility and uncertainty, leading to additional monetary policy measures to support financial markets, which included additional rate cuts. Amid the market turmoil, investors sought safety and liquidity, leading to increased demand for safe-haven strategies, notably money market funds. This surge in demand pushed prices higher and yields lower.

Fast forward a couple of years later, and money market fund yields have risen dramatically. In 2022, the Fed signaled plans to tighten monetary policy in response to rising inflationary pressures. Eleven Fed rate hikes later, MMFs are yielding a healthy 5-plus percent, marking the highest level since 2007 (1). The acronym TINA, which originally stood for “There is no alternative” to stocks and gained popularity in 2013, has now transformed into “TARA” or “There are reasonable alternatives” to stocks.

Figure 1. Source: Federal Reserve of St. Louis

Record Inflows

The rise in short-term yields has prompted both institutional and retail investors to flock to the asset class, resulting in historic levels of inflows into money market funds over the past several quarters. In 2023 alone, money market fund assets saw a substantial increase, rising by $1.1 trillion and reaching a total of $5.9 trillion by the year's end (3). During the first quarter of 2024, assets surged further, crossing the $6 trillion mark.

Rates Peak in the U.S.

While money market funds have experienced a notable increase in both assets and yields, it appears they may have reached their return ceiling. Federal Reserve Chair Jerome Powell reiterated in March 2024, during the central bank's semiannual monetary policy report to Congress, that interest rates are likely at their peak (4). While investors may not see a rapid decline, Powell suggested that rate cuts are still a possibility for 2024, signaling the eventual decrease in short-term interest rates. For investors looking to deploy cash or reallocate from money markets, history has indicated that fixed income and equities have on average delivered attractive returns following rate cuts.

Stock and Bond Payoffs After Fed Rate Cuts

While each rate cut cycle presents unique circumstances, a more accommodative stance from the Federal Reserve can foster a conducive environment for equities. Rate cuts can benefit equities in several ways; reducing borrowing costs can stimulate economic activity, boost investor confidence, and increase the relative attractiveness of equities compared to other asset classes

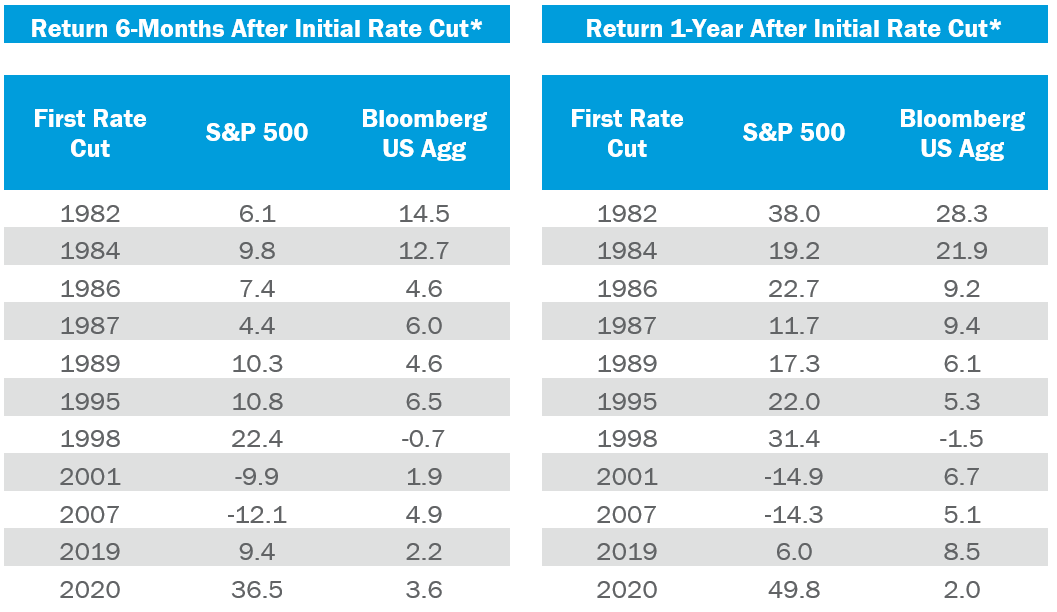

If history is a guide, above-average stock returns tend to follow rate cuts. Over the past 11 rate cut cycles dating back to 1982, the S&P 500 averaged a return of around 8.7% and 17.2% over the six months and one year following an initial rate cut. Positive equity market returns were observed in 9 out of these 11 rate-cut cycles. The two exceptions occurred during particularly tumultuous periods for the stock market: firstly, amid the 2001 dot-com bubble, and secondly, during the onset of the subprime housing crash in late 2007. Bonds (as represented by the Bloomberg US Agg) on the other hand, managed to achieve positive returns during the challenging market conditions of 2001 and 2007, highlighting the benefits of diversification within an investment portfolio.

Fixed income has generally benefited from rate-cut environments. Unlike money market funds, fixed income can benefit from securities with higher coupon rates that may increase in value as interest rates decline. This capital appreciation can enhance the total return of a fixed income portfolio, whereas MMFs typically maintain a stable net asset value (NAV) of $1 per share, limiting the potential for capital appreciation. In addition, fixed-income strategies can take advantage of falling interest rates by investing in longer-duration bonds. As yields on new bonds decline, older bonds with higher coupon rates become relatively more attractive, leading to an increase in their price and potentially improved returns for investors.

The Bloomberg US Aggregate has on average returned 5.5% and 9.2% over the six-month and one-year periods following an initial rate cut. Conversely, due to their investment in short-term, low-risk securities, MMFs typically experience declining returns in line with decreasing interest rates.

*Source: Morningstar. The returns shown represent the 6-month and 12-month calendar total returns from the date of the first cut in Federal Funds Rate by the US Federal Reserve, across different rate cut environments.

Conclusion

Money market funds offer investors valuable benefits such as safety, liquidity, and stability, making them ideal for short-term cash management and preserving capital. However, for investors with a longer-term investment horizon, allocating funds to equities and fixed-income securities may offer improved returns, inflation protection, diversification benefits, and potential for long-term growth. Ultimately, striking a balance between the short-term stability of MMFs and the long-term growth potential of other asset classes can help investors achieve their financial objectives and navigate various market conditions.

Sources:

Mr. Shiras is a member of Canterbury’s Research Group and is responsible for sourcing, evaluating, and monitoring traditional, long-only equity managers. Mr. Shiras serves on Canterbury's Fixed Income and Hedge Funds Manager Research Committees, and as vice chair on the Global Equity Research Committee. He also serves on the Capital Markets Committee. Prior to joining Canterbury, Mr. Shiras served as a financial analyst with Apriem Advisors, where he conducted security and economic research, and was an investment analyst with NFP Retirement, where he contributed to strategy and market research. Mr. Shiras received a Bachelor of Arts in business administration from the University of California, Irvine. He is a CFA® charterholder and a Chartered Alternative Investment Analyst.